Welcome to Liquidity Performance.

Connect, protect, forecast, and optimize your cash flow and liquidity—all in one powerful platform.

Connected. Actionable. 100% secure.

Leverage liquidity to build strategic advantage.

For CFOs

Make strategic decisions with confidence—based on a crystal clear picture of your firm’s financial resources.

Learn More

For Treasurers

Know, protect and optimize how you manage liquidity to improve financial health.

Learn More

The truth is in the numbers.

90%

reduction in idle cash.

$>1M

in fraud avoidance.

87%

overall risk elimination.

Does your liquidity platform do this?

-

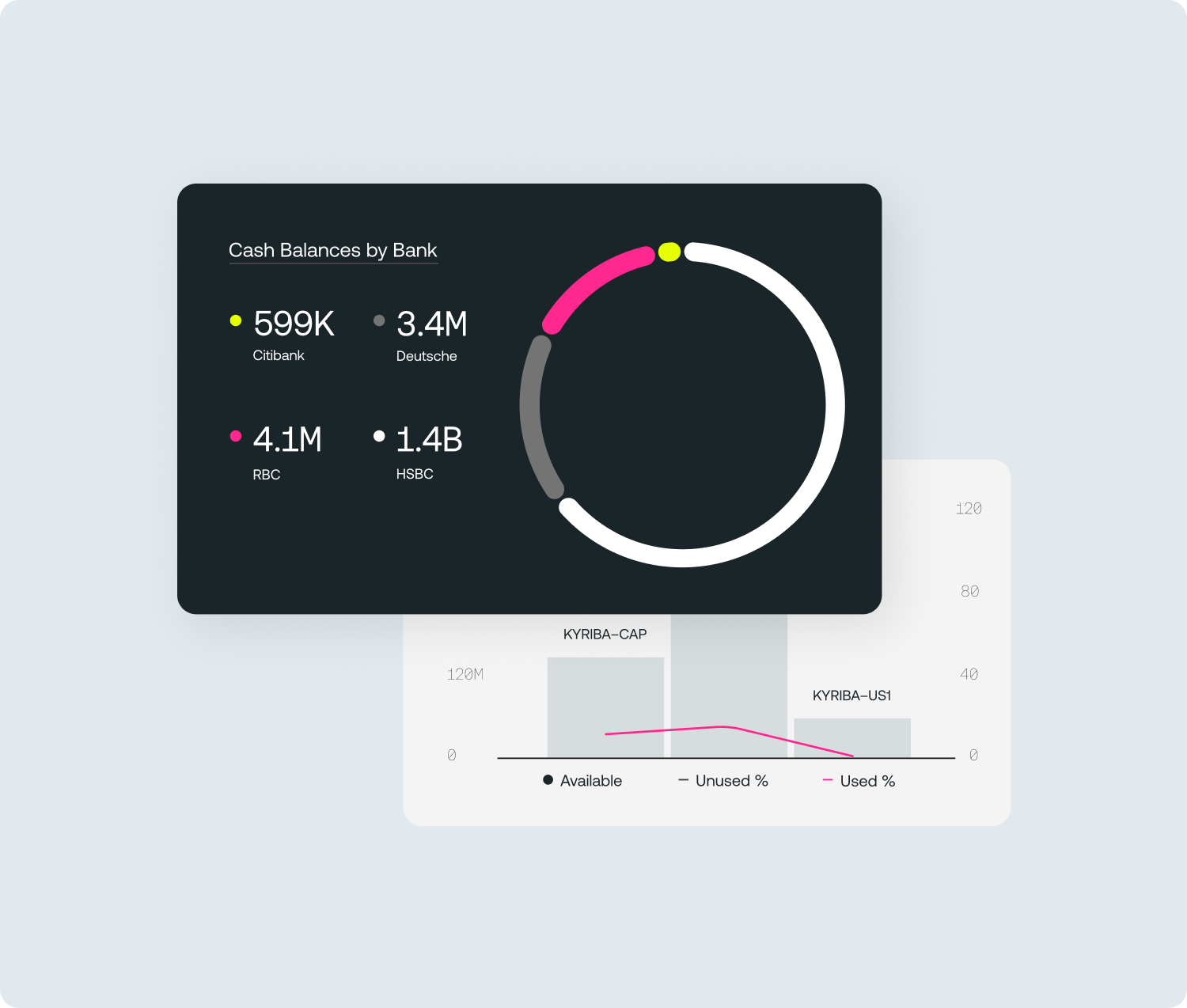

Daily connections to

1000+ banks.Unify bank and ERP data to automate, move

and control liquidity. -

A single source of

liquidity truth.Manage all your liquidity from a centralized,

powerful platform. -

Actionable risk

management.Hedge or reduce exposure, mitigating the

impact of market volatility on financial

performance. -

Precision

forecasting.Project cash, liquidity and exposures with

greater accuracy and improved flexibility. -

Secure payments,

everywhere.Control all payments from one platform with

APIs from ERP to bank, optimizing processes

and reducing fraud. -

Personalized Menu

Maps.Design your user journey to optimize data and

processes, so you get what you need when

you need it.

“With Kyriba, we achieved 100% cash visibility, unlocked $9B in investment capital, and reduced working capital 90%.”

Read the success story